Sampling of granite rocks in the core shelter. © ES-Géothermie (ESG)

The European energy transition will be built on electrification, relying on clean technologies highly depending on metals, the majority being listed as critical and strategic raw materials. JRC’s Foresight Study, assessing supply chain dependencies and predicting materials demand until 2050, highlights EU’s need to diversity and secure a more resilient resourcing of needed metals. Additional recommendations refer to the necessity to explore Europe’s potential to build internal capacities for mining, refining and processing materials needed for battery production.

In the coming years, demand for lithium-ion batteries (LIBs) will be driven by the automotive sector, complemented by the demand for energy storage systems (ESS) storage requested by the deployment of renewables. Compared to the current supply of materials, major increases are foreseen for graphite (45% in 2030 and 85% in 2050) and lithium (Li) (100% in 2030, expected to reach 170% in 2050). In 2030, the cobalt (Co) demand for batteries will represent almost 60% of the current world supply, expecting to decrease to 40% in 2050, partly due to the shift towards more nickel-rich batteries [source: Foresight Study, JRC].

In the current scenario, overshadowed by geopolitical instability and reliance on powerful nations for critical minerals, the recently adopted Critical Raw Materials Act (CRMA) underpins, among other solutions, the need to turn towards domestically sourced recycled metal, which will help reduce reliance on imports or single sources. With clear objectives to strengthen EU’s capacities along the entire value chain, the CRMA additionally sets a threshold for the EU’s processing capacity, which should cover by 2030 at least 40% of the domestic annual consumption of strategic materials.

Researchers from SINTEF have been studying the possibility of recovering Li, nickel (Ni) and Co from secondary raw materials such as black mass, as well as Li from primary resources – spodumene concentrate. The team at SINTEF approached the task by converting the metals in raw materials using molten salt chlorination, a process that could become an alternative to state-of-the-art (SoA) hydrometallurgy.

Researchers conducted experiments on three types of input materials: one spodumene concentrate and two different samples of black mass (BM), the first one of unknown battery chemistry and pre-treatment, while the second BM sample, recovered from an NMC material, had undergone pyrolysis pre-treatment.

The experiments allowed researchers to study the thermal expansion and melting behaviour of the spodumene concentrate, obtaining the highest Li yield (100 %) when chlorine gas is used in a mixture of calcium chloride, sodium chloride and potassium chloride at a temperature of 727 ⁰C . Experiments on black mass material showed the highest chlorination yields were obtained from uncalcined material (Li 64 %, Co and Ni 22-24 %, Cu 83% and Mn 49 %) in a mixture of lithium chloride and potassium chloride at at 470 ⁰C.

The results of this research was presented by SINTEF representatives at the Joint Symposium on Molten Salts in November 2023.

Discover the scientific publication

© visual: SINTEF

Author: ÉS-GÉOTHERMIE [ÉS-G]

Among European geothermal sites, the Upper Rhine Graben (URG) has a great potential for a lithium (Li) production from geothermal brines due to its high concentration and the significant water flows exploited by the geothermal power plants in this area.

Despite its great potential, certain gaps in the basic knowledge of the geochemistry of the URG rocks are persisting, as there is scarce conclusive investigation carried out in the past to estimate the Li content as well as the mechanisms of Li recharge in brine. Identifying Li-rich geological units are essential to target areas with higher Li concentrations for exploration and to ensure the sustainability of this resource.

In geothermal systems, hydrothermal fluids circulate through the fractured and porous rock formations, undergoing complex interactions with the surrounding lithology. Various processes, such as leaching, dissolution, and precipitation, can occur and they can significantly influence the concentration of Li in the circulating fluids. Knowing the chemistry of the reservoir rocks could help us understand chemical reactions occurring between the hydrothermal fluids and the rocks and therefore how Li is mobilised and transported into the geothermal brine.

In the LiCORNE project, ESG is conducting detailed geochemical analysis of several core drills including granite, sandstone, and limestone from geothermal wells drilled in Northern Alsace. Researchers finalised the rock sampling task at the beginning of 2024, while the chemical measurements are expected at the end of June, current year.

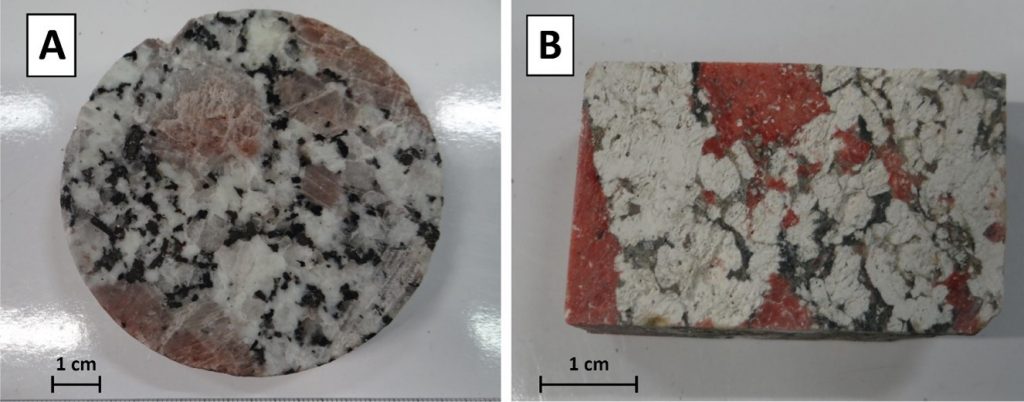

Sampling of granite rocks in the core shelter. © ES-Géothermie (ESG)

In total, 57 samples were collected and closely studied, which facilitates understanding of the chemical elements behaviour in the rock before and after the hydrothermal circulation/alteration. Comparing the results of this on-going investigation with the few data available in literature and referring to the Li concentration in URG rocks could reveal an unexpected behaviour of Li in the geothermal reservoir rocks.

After careful analysis of the chemical composition, isotopic analysis of the same rock will follow which will show more accurately potential sources of Li in the geothermal brine.

A. Fresh monzogranite sampled at 1774.5 m depth); B. Hydrothermally altered granite showing argillic alteration sampled at 2159.30 m depth. © ES-Géothermie (ESG)

Author: ADMIRIS [ADM]

ADMIRIS [ADM], partner in WP9 [Communication, Dissemination and Exploitation] and responsible for designing and proposing a sound business model for the LiCORNE project, successfully delivered the preliminary market and logistics analysis. This initial study marks an essential milestone in the journey towards understanding the optimal LiCORNE value chain and is the first step in a series of three reports designed to reach the project’s final business analysis.

The scope of this preliminary analysis was extensive, focusing on understanding the dynamics of the market through supply-demand analysis, pricing evaluations, and logistics assessments. Delving into these key areas allowed researchers to gain valuable insights that would facilitate the selection of the most suitable locations for the LiCORNE plant facilities. The study examined the external dynamics of lithium products, thus identifying market trends, challenges, and opportunities. This comprehensive picture of the market landscape will allow partners to pinpoint optimal plant locations that align with the project’s strategic objectives.

Main take-aways from this preliminary study:

The results of this preliminary analysis are promising, showcasing several potential plant locations that offer favourable conditions for the LiCORNE technologies within Europe. These findings pave the way for further exploration and refinement as we progress towards our ultimate goal of establishing a robust and efficient Li value chain.

In advancing the development of LiCORNE’s business case, the consortium partners remain committed to leveraging these insights to drive the success of this project that has the potential to revolutionise the lithium industry and deliver innovative solutions to meet the growing demands of the market.

© Photo: Minakryn Ruslan (under Adobe License)

Using alkaline leaching process on spodumene concentrate, the maximum extraction of Li achieved thus far reached 75%. The leachate transformation, even after the filtration step, hinders the sample analysis and further processing. To overcome this challenge, upcoming experiments will explore elevated temperatures, diverse additives, and further investigate the chemical precipitation process.

During the advanced solvometallurgy applied on spodumene concentrate, the research team at TECNALIA reported high Li leaching yields (>95%). Their future work will focus on the further optimisation of the operational conditions, more appropriate for the anticipated scalability phases of the process. On the other hand, solvometallurgical tests carried on waste cathode material achieved high leaching yields for all target elements (Li, Co, Ni, Mn) using mild operational parameters.

After the first experiments engaging reactive milling and aqueous leaching [treated with aluminium- (Al) and calcium (Ca) – salts] on waste cathode material, researchers at KIT reported close to 31% Li recovery rate. Samples supplied by UMICORE were leached under different conditions to extract Li – available in the form of Li carbonate [LiCO3], and further subjected to purifications processes employing various reducing agents. Future efforts for this particular task will focus on adjusting leaching temperatures, establishing an optimal purification process, and evaluating Li recoverability in both Al and Ca systems.

Anticipating future upscaling phases, researchers at VITO, working on the Li-sieve adsorption and desorption from aqueous leachates, shaped the lithium-titanium-oxide (LTO) adsorbents into spheres, which enabled dynamic testing. The team is currently optimising the flow rates for adsorption and desorption to model the optimal conditions for upcoming processes. While initial tests utilised synthetic Li solutions, upcoming research will extend to purification processes for spodumene leachates.

In the same work package, TECNALIA performed experiments using different organic solvents for the liquid/liquid (L/L) extraction from brines showing promising Li yields in the range of 40-60 %.

Within the same work package, EnBW scientific team has been working on designing an eco-friendly Li-desorption process from brines, focusing on the development of novel synthesis for Mn-based adsorbent material. Notably, the successful upscaling of the synthesis process from 2,5g to 200g marks a significant achievement in sustainable material synthesis.

Finally, the last task of WP5 – Electrode-based Li adsorption and desorption from brines, conducted by KIT, presented the conclusions of their research work carried during the last six months, which includes a 4-step process. Their work has been focusing recently on the optimisation of the electrode pre-treatment, the establishment of the current densities and the reduction of the Na contaminations. Despite high Li selectivity rates obtained thus far, their work in the upcoming months will centre around optimising the recovery efficiency and the selectivity. Future experiments will test different thermal operating conditions (40°, 60°, 80°), but will also attempt to scale-up the process.

In the final technical work package, SINTEF scientists are pioneering a two-step process which involves in a primary phase selective chlorination by converting insoluble oxides to soluble chlorides; this is followed by a second step – electrolysis of the soluble chlorides extracting the target elements. After conducting different chlorination experiments, researchers emphasised the importance of time and the processing duration, confirming over 65 % Li recovery rate. With promising results, their focus pivots towards the second step – electrolysis.

Read the next article for a comprehensive overview of the meeting.

Marking the project’s first anniversary, the LiCORNE partners gathered in sunny city of Athens to draw the line and brief on the progress achieved thus far. The meeting was hosted by the National Technical University of Athens (NTUA) and it unfolded over two days, including also a visit of the NTUA mineralogical museum and its metallurgy laboratory facilities.

Press the “play” button below to watch snippets of the 1-year consortium meeting and interviews with various partners

https://www.youtube.com/watch?v=ZN-tMSWtICg

Starting with work package (WP) 2, partners from EnBW presented the characteristics of the Bruchsal geothermal reservoir, located at the eastern edge of Upper Rhine Valley. EnBW highlighted that geothermal brines in the Upper Rhine Valley are recognised for their relatively high lithium (Li) concentrations. Additionally, the region displays an extension structure striking in the NNE-SSW direction, with a length of around 300 km and a width of up to 40 km. In this area, the deep geothermal fluids utilised for geothermal applications exhibit a maximum Li concentration ranging from 163 to 190 mg/L (Sanjuan et al., 2016). The highest Li concentration was detected in the hydrothermal alteration zone of Lower Buntsandstein.

In the forthcoming months, new samples are prepared for delivery to research partners: geothermal and continental brines, but also Li-phosphate samples, a new Li-mica concentrate and synthetic brine solutions. Upcoming research will mainly focus on the geochemical analysis of rock samples from the reservoirs.

In the mining industry or extractive metallurgy, beneficiation is any process which removes the gangue minerals from ore to produce a higher-grade product, and a waste stream – which, despite the lack of valuable materials, needs to be sustainably treated. In charge of the beneficiation step, TU Delft already presented in M12 videos of the operational opto-magnetically-induced sorting lab setup to process crushed spodumene ore. This proof of concept aims to separate the Li-rich fractions of the ore before reaching the metallurgical processes. This preliminary step helps improve efficiencies and decrease cost in processes downstream.

Researchers at NTUA, working on the development of a calcination technology working at lower temperatures, presented the first results of their investigations using various additive combinations and leaching experiments studying the effect of temperature, time and leaching agents. Tests showed that the use of additives has the potential to maintain the calcination operating temperature of spodumene at low temperatures compared to conventional routes. Moreover, researchers achieved over 92 % Li extraction during various leaching experiments conducted so far. Recognising the environmental footprint associated with the conventional routes used for Li extraction, NTUA research team will continue experimenting with new additives in order to develop a new technology that is more environmentally sustainable and equally more competitive.

Working with spodumene samples, TECNALIA researchers have been working on the ball milling-assisted chemical transformation, testing the use of various additives and experimenting with different thermal treatments. Their upcoming work will focus on optimising the ball milling process to obtain materials with similar leaching properties but being produced with less intense thermal processes.

Read the next article for a complete overview of all the work packages.

Lithium (Li), a highly versatile element, finds extensive applications in diverse industries including ceramics, glass, fuel cells, metallurgy, pharmaceuticals, aerospace, and lithium-ion batteries (LIBs). With the demand of LIBs increasing, particularly fueled by portable electronics and electric vehicles, the global lithium industry is undergoing rapid expansion. Due to its lightweight and reactive properties, Li is considered the essential component in high-energy-density batteries, playing a crucial role in the future of sustainable energy. But the extraction of Li resources has become a critical concern.

VITO employs an innovative process known as Gas-Diffusion Electrocrystallisation (GDEx) technology to achieve the direct extraction of Li, that leverages gas-diffusion electrodes to orchestrate a meticulously controlled chemical transformation. By precisely manipulating its parameters, GDEx enables synthesis with minimal chemical additives, marking a significant milestone in this field. The unique design of the reactor maintains a consistent set of conditions, and by simply altering the inlet solution, it can produce the desired target structure. This approach is highly scalable and promising for the future of Li extraction and synthesis.

Following comprehensive investigations performed on synthetic solutions, VITO fine-tuned the operational parameters to be applicable to natural brine solutions and leachates. The experiments carried out on diverse brine solutions yielded remarkable results, with a Li removal efficiency exceeding 95% from these solutions. The planned process involves producing layered double hydroxide structures which can further be downstreamed to battery cathode material.

Learn more about the GDEx process in the previous article: Recovery as battery-grade chemicals

©Adobe Stock Photos, Salinas Grandes, a huge salt flat in Jujuy and Salta, Argentina.

In July 2023, International Energy Agency (IEA) released its inaugural “Critical Minerals Market Review”, along with their new online data explorer. Between 2017 and 2022, the demand of lithium (Li) tripled, primarily due to the energy sector’s reliance on it. According to the report, the market for energy transition minerals is poised for continued rapid growth, placing increasing pressure on the global mining industry.

Looking in particular at the Li price fluctuations, the study reports increases in 2021 and early 2022, accompanied by strong volatility. However, the latter half of 2022 and the beginning of 2023 saw more stable trends, albeit still remaining above historical averages.

Not unexpected, investment in the development of critical minerals, particularly Li, recorded a significant surge of 30% in 2022, building upon a previous increase of 20% in 2021. The IEA analysis examined the investment patterns of 20 major mining companies actively involved in the production of minerals essential for the energy transition. It revealed a substantial rise in capital expenditure specifically allocated to critical minerals. This upward trend can be attributed to the favourable momentum propelling the adoption of clean energy solutions, such as the most recent EU Regulation on Batteries and Waste Batteries. According to the IEA analysis, companies specialising in Li development witnessed 50% rise in their investment spending. Fuelled by the rising demand of electric vehicles, large industrial groups are competing now in a quest to secure mineral supplies: General Motors announced a 650 million USD in Lithium Americas, while Tesla confirmed already plans to build a Li refinery in Texas (USA).

Along with its ‘Critical Minerals Market Review 2023’, the IEA also launched the IEA Critical Minerals Data Explorer, an interactive tool that facilitates access to the agency’s projection data.

The IEA analysis conclusions raise the concern of the diversity supply. The LiCORNE project was launched at the encounter of European aspirations to advance the energy transition. The project aims to increase the European Lithium (Li) processing and refining capacity to produce battery-grade chemicals from ores, brines and off-specification battery cathode materials. Over a span of 48 months, from the 1st of October 2022 to the 30th of September 2026, eight research and development centres in Europe will investigate no less than 14 new technologies for extracting, recovering and refining Li.

Currently in its first year, the LiCORNE project completed the task of characterising and providing materials for the R&D activities. Most of the materials are sourced from European resources, including spodumene and Li-rich mica from mines in France and Austria, and geothermal brine sampled from the Upper Rhine Graben (France and Germany). The synthetic brine is prepared in UK. Only continental brine and off-specification cathode material originate from non-European countries – Chile and Korea.

For more information, refer to the detailed article, and explore the available Li resources in Europe.

On 16 March 2023, the European Commission proposed a comprehensive set of priority actions to ensure the EU’s access to a secure, diversified, affordable and sustainable supply of critical raw materials (CRMs). With the demand for CRMs expected to skyrocket, Europe needs to mitigate the risks associated with the supply chain of strategic minerals, as highlighted by shortages in the aftermath of the Covid-19 and the energy crisis.

During the official statement, President of the European Commission, Ursula von der Leyen highlighted:

“This Act will bring us closer to our climate ambitions. It will significantly improve the refining, processing and recycling of critical raw materials here in Europe. Raw materials are vital for manufacturing key technologies for our twin transition – like wind power generation, hydrogen storage or batteries. And we’re strengthening our cooperation with reliable trading partners globally to reduce the EU’s current dependencies on just one or a few countries. It’s in our mutual interest to ramp up production in a sustainable manner and at the same time ensure the highest level of diversification of supply chains for our European businesses.”

In addition to an updated list of critical raw materials, the Act presents a set of clear benchmarks for domestic capacities along the strategic raw material supply chain, and to diversity EU supply by 2030:

Eurometaux’s immediate reaction, openly stated by the Director General Guy Thiran, emphasised : “Europe has a meaningful project pipeline for the mining, processing and recycling of base metals, battery materials, and rare earths (inside and outside its territory). These can be brought online by 2030 under the right conditions, adding to Europe’s existing production with the same guarantee of high climate and environmental performance.”

Although the proposed Regulation needs to pass the European Parliament‘s and the Council of the European Union’s evaluations before adoption and entry into force, the initiative sets a clear regulatory framework to support the development and the sustainable exploitation of domestic Li resources.